DeFi is Bonkers. I love it. Here's why.

I'm at the point where I don't take this seriously and I make textual memes of DeFi.

TL;DR: DeFi mimicks traditional institutions and allows me to turn $1 of imaginary money into $3 of imaginary money. USD is also imaginary money.

Hi Curious Readers of Professional Curiosity!

At the time of this writing, you will have woken up to Solana getting hacked. I unfortunately, didn’t cover that. Instead, today I’m hacking your brain space by talking about DeFi Leveraged Lending.

That’s right.

Crypto and Finance.

Let’s get nerdy!

Building on the established craziness that is DeFi, recognizing the failings of unstable stablecoins, and knowing how a period of falling prices can destroy DeFi Lending, today I am going to explain to you how DeFi Lending works, and why it’s bonkers.

And why I love it.

As always, you can find TL;DRs and graphics going nuts explaining the concepts.

Cheers!

In Case You Missed It (and relevant to this)

Sections You Can Skim To

Round 1: Minting/Borrowing Stablecoins

Round 2: Borrowing Stablecoins with Stablecoins

Round 3: Leveraged Borrow Stablecoins

Stretching One Dollar

Incentives to Lend and Borrow

How is this legal?

What is Loan to Value?

What are the risks of leveraged lending?

Closing comments

Round 1: Minting / Borrowing Stablecoins

TL;DR: I give you crypto coin, you give me stablecoin. k thanks.

The DeFi world is fast. You can use your crypto assets to take out a loan against it in a few clicks. In someways, its crossfit but in finance.

The way it works is this:

You have some crypto.

You deposit crypto in to a protocol.

The protocol algorithmically determines the risk of your crypto based, and credits you the amount you can take. This is called LTV, and I’ll explain at the end.

You use your deposit value to borrow stablecoin. This can also be referred to as Minting Stablecoin as you are creating Stablecoins underpinned by your Crypto Asset.

Congratulations, you have USDX Stablecoins which are backed by your original crypto asset you collateralized it with. We’ll call this the freshly minted USDX.

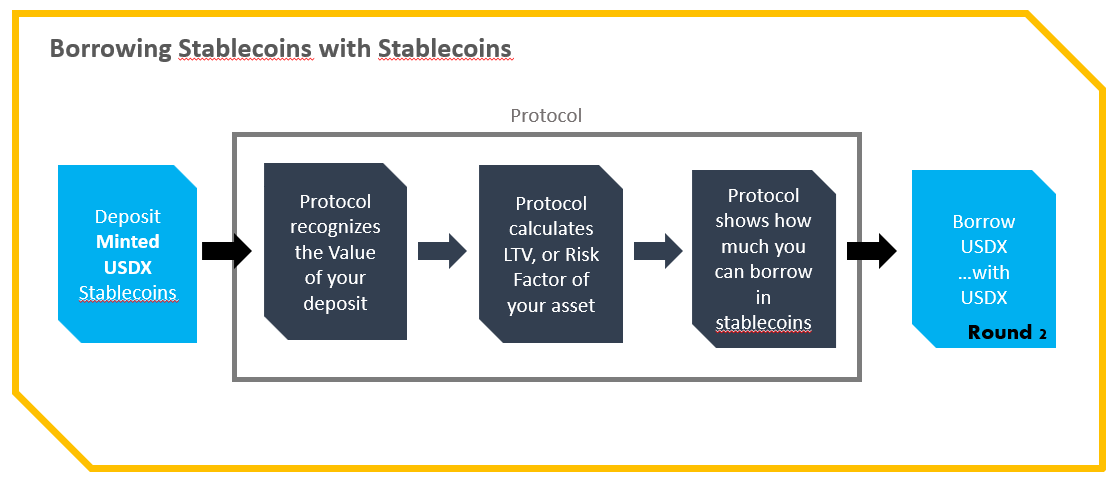

Round 2: Borrowing Stablecoins with Stablecoins

TL;DR: I give you stablecoin…you give me stablecoin?

Now that you have minted USDX, we’re going to do it again. I’m serious.

Using your minted USDX, you’ll deposit it in to a protocol and repeat the process.

At the end of it, you have borrowed USDX with USDX.

Round 3: Leveraged Borrow Stablecoins

TL;DR: I give you your stablecoin…you give me more stablecoin?

Using your borrowed USDX, which was borrowed for with USDX that you minted, you are quite literally, going to do that again.

Deposit your Borrowed USDX

Borrow USDX based on that borrowed USDX amount.

Nothing can go wrong borrowing stablecoins.

Just like Inception, repeat to the nth time. I think. You’ll hit diminishing returns if you stay on the same platform, but you probably could go to another DeFi protocol. It’s not like there’s any “Know your customer” procedures in DeFi to validate your total outstanding loans.

Stretching One Dollar

TL;DR: Show me the money.

You might be wondering, what the point of this madness is. The answer is simple.

I am stretching the value of $1 worth of my crypto asset, and every borrowing round, I am getting more spending power, even though I don’t technically own more than $1.

I minted (borrowed?) USDX because it allows me to keep my original crypto asset intact.

I still retain ownership of my original cryptoasset (because you know, I don’t actually want to give it up)

Get another crypto asset that I can use, so long as I pay the interest fees or usage fees.

At this stage, I am making a bet:

I can earn more money borrowing than the monthly/yearly interest on the loan and I’m assuming the value of my original crypto asset will not drop significantly as I do this.

Think of it this way, I have a sitting asset I don’t want to give up.

I take out a loan against it.

I use the loan and put it in investments that earn a desired interest rate.

My earned interest rate > the interest on my loan.

When I’m done, I withdraw and close my position by paying back the principal borrowed amount minus interest, I keep the gains, and I get my original asset back.

Incentives to Lend and Borrow

TL;DR: You give me more money to give you money.

Oh by the way, just like Credit Card Rewards, DeFi Protocols offer DeFi rewards.

At this stage in the game, it’s expected for DeFi protocols to offer the equivalent of credit card reward signups for depositing crypto with that protocol. The reward rate will wildly vary, but can be absurd if you are the first mover, or if its a DeFi platform trying to grow.

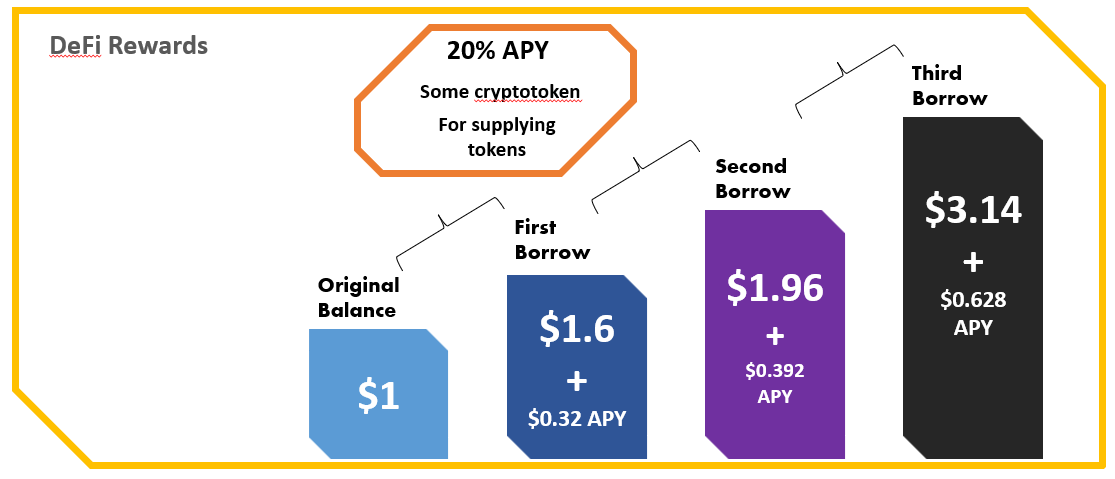

In this example, a DeFi protocol may incentivize you with 20% APY in the form of their tokens (maybe even 40%) if you choose to deposit your crypto with them and keep the deposit with them over a long period of time.

This effectively stretches what $1 is to $2 in the first lending and borrowing round.

You might be thinking, how is this possible and why is this legal?

TL;DR: DeFi mimicks real life institutions.

Well, that’s simple too. DeFi mimicks real life institutions. Nothing you see in DeFi hasn’t already been done our financial capital markets. Our entire traditional financial system including banks, broker-dealers, hedge funds, and life insurance companies, are engage in leveraged lending. (Federal Reserve, May 2021)

The expectation used: The cost of debt is lower than what I expect to earn.

The assumption going in: Leveraged financing is done with the goal of increasing an investment’s potential returns (Internal Rate of Return)

The assumption used: the investment increases in value.

What is Loan to Value?

TL;DR: LTV is your financing rate, basically.

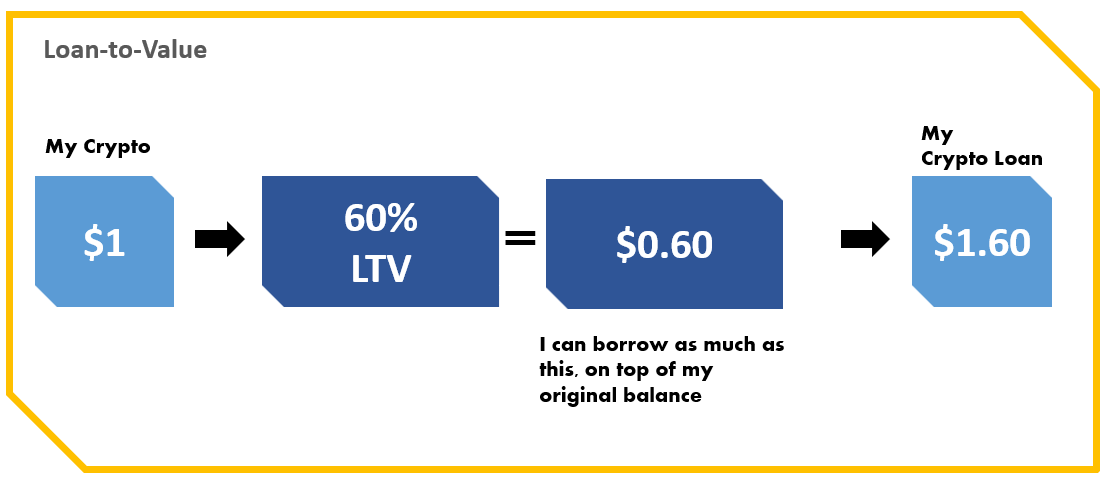

Recall that a DeFi protocol uses “LTV”, or Loan-to-Value, to calculate what your crypto asset is worth.

LTV is determined by various risk factors including value of your asset, and volatility. Stablecoins happen to be more stable (eh) than other regular crypto currencies.

In this manner I take $1 worth of my whatever crypto, the DeFi protocol assess the risk and says I can take a 60% LTV on it, and lets me borrow.

How much can I borrow? Original + LTV, or $1.60.

The agreement I am making is that I would pay the DeFi protocol in its terms:

Interest, due periodically or at withdraw

Any maintenance fees, if that exists

My original crypto asset maintains value, or is determined to recover its value if it does drop. Usually.

What are the risks of leveraged lending?

TL;DR: If your original crypto asset drops in value enough, you lose everything.

What happens when your original crypto asset, which by the way the entire DeFi Lending is based on, drops significantly in value?

You lose.

Typically in a traditional lending agreement, the value of your asset that is being used to back a loan, aka the collateral, can not fall below a certain value threshold. If it does, your loan can be closed out and your position fully liquidated, and what is salvageable goes to the institution who lended you money to begin with.

In the traditional financing world, institutions can simply not act on a contract and instead, take that leap of faith in you. There could be inputs not specified in a contract that they know determine the outcome in your favor.

In DeFi, protocols are blind without intervention. If this scenario happens in DeFi, you simply get closed out with no judgement to you, or your character, because the smart contract does not consider those factors when enforcing the loan terms.

Check out what happened to Solend to see how this played out in DeFi.

Closing comments

TL;DR: DeFi lending can be a cheat code to amass real capital to buy out people using a technology hack the equivalent of a TikTok life hack video. Basically.

Many leveraged loans “possess weak structures” that “reflect layered risks that include some combination of high leverage, aggressive repayment assumptions, weak covenants, or terms that allow borrowers to increase debt, including draws on incremental facilities. The number of loans and the eroding of safeguards in each transaction are growing. (Bloomberg February 2022)

However, leveraged loans are typically given to…

Companies with high debt or poor credit history. I know.

Leveraged loans are the traditional financial banking equivalent of PayDay loans, or high interest travel reward credit cards. Albeit, less risky than the two consumer counter parts.

Now it isn’t all just that, but they are frequently used the way.

Home Equity

Another not related to the above example of a leveraged loan is if you do a home equity loan. I don’t know, I don’t own a home, but you can do that.

In a period of rapid expansion, leverage lending is a multiplier. But it’s a double edge sword. I mean, as much as I make fun of DeFi, I make fun of capital markets regularly now. Traditional banks are saying they are at risk for $80b.

DeFi as a Credit Card Reward Gimmick

In DeFi, leveraged lending is currently used as a mere incentive to accelerate the adoption of a cryptocurrency. Until we start seeing actual and ubiquitous business models in DeFi where I could use a leveraged lending to buy out businesses, we are stuck with Credit Card Reward gimmicks.

Anyway, hope you enjoy this tidbit. Been meaning to talk more DeFi.

p.s. don’t get me started on the underlying accounting and tax part of it.

Like wat.