How One Wallet Could Take Out a Network

I'm not an economist, but I'm pretty sure we're living in an economists wet dream right now.

TL;DR: Allen watched a Solana Lending Protocol and its community implode on ethical dilema in a Kobayashi Maru style test, because one wallet had the power to wreck everything.

Hi curious readers of Professional Curiosity!

I’m thankful for everyone that has subscribed to my newsletter.

I get a lot of joy in thinking, writing, and interacting with everyone. This is where I go for intellectual sparring and to learn. It’s also how I’ve gotten a few business engagements. It’s what I want to do instead of playing video games.

The newsletter has a lot of significance to me, so I have a favor to ask of all of you:

Can you refer my newsletter to others?

Thank you.

On wards to today’s piece.

Early this year, so like last month, Stablecoin Luna was depegged, of which a savings protocol was one of the factors that caused it to die. You can read my summary here. Succeeding that was the collapse of Three Arrow Capital, another cryptocurrency fund, and some others.

This time, we’re back, and instead of Stablecoins, its Solana - the largest Proof of Stake network, and a Solend, lending protocol.

As always, you can find TL;DRs and graphics ranting explaining the concepts.

In Case You Missed It

Sections You Can Skim To:

How does a Lending Protocol work?

What’s up with Solend?

What makes Solend special?

What’s the risk?

What was the response?

WTF?

What’s the Important Take Away

TL;DR: If you want to borrow money, you need to put something up that I can take should you fail to pay me back - now automated!

A lending protocol allows users to lend and borrow crypto-based assets instantly. You deposit some crypto asset as collateral so that you can borrow another crypto asset whatever the rates are.

You’ll get it instantly, with technology-based code executing in the background in real-time to process, account, and distribute your order.

In a way, you’re saying “hey please lend me crypto, here’s another crypto you can hold. I’ll pay you the principal balance, plus some interest and monthly usage fees.”

In theory, a lending protocol by itself isn’t anything bad. But my understanding of lending protocol is mostly tied to small balances, you know, chump change. Like a cool million.

What happens when the example isn’t in the 7 digits, but in the 9digits? That’s what happened in the case of Solend, and the story gets far more intriguing.

TL;DR: Liquidations happen if the value of your position drops too low

Solend, a Solana based lending protocol, avoided being out right screwed through a measure of last resort. As crypto-winter has emerged, with every single crypto being devalued by more than 50%, lending protocols are at an incredibly high risk of having accounts doing business be liquidated as a result of dropping crypto assets that have been collateralize dropping in value.

Why do accounts get liquidated?

Lending is a risky business.

What happens when you don’t get your money back?

To derisk lending activities, lenders will ask you to collateralize, that is to say, put up some assets, that will be forfeited to the lender should you fail to meet your bargain.

Usually it’s a minimum 1 to 1 value. Often times its 60% of value - so to get 60 cents you have to collateralize $1 dollar. The rates can change.

You could take out a $50k loan if your car is worth $50k at time of lending. What happens when the car drops in value?

Well let’s change the conditions, make it safe, and say you can only take out a $30k loan for that $50k car you are collateralize ,so even if the car drops 25% value, and the person who owns the car defaults, the lender can still profit / minimize loss.

Okay but what happens when the car drops 50% of value, even 75% of value?

A $30k loan, on a car worth originally $50k, now is worth $15k (the car).

Ladies and gentleman, the lender has thought of and puts in a floor value or liquidation price - if your asset drops to the floor value, the lender will sell your car and close your account.

TL:DR: Solend Lending Protocol has 1 extremely large account that carries 95% of the risk exposure for everyone else, plus the ability to take out the Solana Network as a whole given its size.

Solend is special…ly screwed given the risk exposure. A wallet was identified with the following details:

5.7M SOL was deposited by one account

It was borrowing 108M in USDC and USDT Stablecoins (think of a 1 to 1 ratio with the US Dollar)

It represents 95% of all Solend’s Solana Main Pool Deposits.

It also represents 88% of all USDC stablecoin borrowing activity.

Last activity 12 days ago from the date it was reported.

When we think of DeFi, often the amount we’re thinking is rather small.

This wallet carries 2% of the total available Solana tokens in all of the global distribution, and represents 95% of all the Solana Solend has on their protocol.

Any move this account makes is considered a market mover - as in it could significantly influence change the market if it decides to sell all at once - or a protocol forces it to do so all at once.

To put it simply, if the wallet defaults, everyone is fucked.

TL;DR: It’s gg for everyone else - its a cascading effect.

This is an account that is basically too big to fail, and if it does fail, it will take out Solend Protocol, the Solana Network, the price too, and probably USDT and USDC a little bit. It’s already locked people out of their USDT and USDC assets.

Here’s what could have happened if it failed (and was liquidated):

20% of the account becomes liquidatable, and is liquidated by the smart contract under lying the Solend lending protocol.

The Solana market would have to absorb 1.1m SOL, or $21m USD, flooding the market.

Specifically the Decentralized Exchanges (DEX) would have to sell it - and it would take a long while for 1.1m SOL to be sold, thus causing an over supply, thus causing a drop in Solana’s value. This would significantly impact the value of Solana and drive it down because of excess supply.

Current Solend depositors on the protocol can’t withdraw, and positions that are backed by USDC and USDT can’t be liquidated either. When this was happening, these users couldn’t do anything.

The drop in Solana value beyond normaly values would cause panic selling, and many lenders who have SOL in lending protocols across presumely other lending protocols, would also start to liquidate (close) their positions and flood the market with even more Solana.

The Solana Network is expected crash. Solana has been known to crash for transactions that are 100x smaller in magnitude.

I have no idea what happens after a Solana Network crash, and it caused by an economic flood.

TL;DR: Solend Labs seized it. Democratically of course. Kind of. But Not really.

After many attempts to get in contact with the owner of the account, and also exploring various other options including modifying the underlying protocol to have a softer liquidating function, the Solend team put up SLND1 Proposal:

“Vote Yes: Enact special margin requirements for large whales that represent over 20% of borrows and grant emergency power to Solend Labs to temporarily take over the whale's account so the liquidation can be executed OTC.”

It is the first proposal ever proposed for Solend.

The Solend team did not vote, and instead ask those who held a Solend Governance Token to vote on the temporary seizure and smart contract upgrade, all to prevent network catastrophe.

Here’s the response.

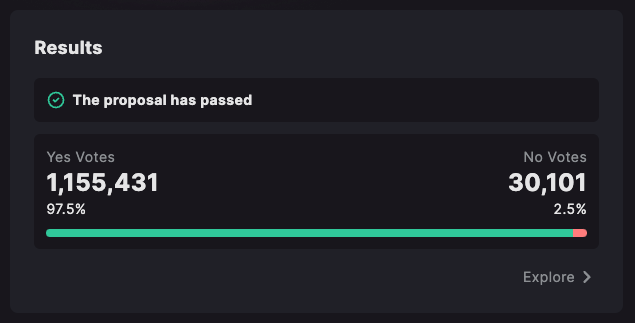

The voters of the platform (Solend DAO) voted 97.5% in favor of the proposal. Except, if I am reading the results correctly from the linekd site, it actually looks like this:

That’s not 1,155,431 individuals voting.

1m of those votes belong to one individual alone (wallet 6HFx)

There were only 127 total voters who participated.

Out of 10,672 possible voters.

Only 1.19% of the population participated, with 95% of the 1.19% voting yes.

They had less than a few hours to make the vote from when it was proposed.

This was on June 19 btw.

TL;DR: A proposal so bad and sus, that the next day a proposal was made to invalidate it, and passed with 99.7% of the votes.

WTF Is the most appropriate response. When designing systems, usually normal use cases that seem real and most likely to happen are what its designed for. But a scenario where 95% of your risk comes from 1 account, and the crypto market was crashing, well that can make you desperate.

Solend team, was desperate.

While SLND1 passed, here’s the criticism, and rightfully so:

It’s a great thread, check it out here.

Hearing the outcry, even with a yes proposal - The Solend team did nothing.

Instead, on the next day - SLDN2 was proposed to invalidate SLND1 and increase voting time to 1 day. That passed, though only 1.48% of all total voters participated.

This corrected the underlying issue of the first proposal by literally invalidating it.

They then introduced SLND3.

Vote Yes: Introduce a per-account borrow limit of $50M, temporarily reduce the liquidation close factor to 1%, and temporarily reduce the liquidation penalty to 2%.

This time, instead of taking over the wallet, they imposed smart contract configuration changes to many things.

This passed with 99.7% of the votes (1.5% of all voters)

TL;DR: It’s an economists wet dream.

This is probably one of the few times in my life, right now, I can watch true Laissez-faire economics happening in real time, with actual data, with actual chat logs, and then watch human behavior intermixed.

If you’re an economist, or a capital market policy maker, this is the greatest time to be alive to get a front row seat to people trying to make economies.

If you like sociology, this is also a great time to be watching.

This Solend scenario is unique in that:

There are no government entities involved - there aren’t even protection laws here

It’s all on one blockchain - Solana, and uses stablecoins (other cryptoassets)

Solend Labs represents a private entity that is attracting users.

Private users can vote directly on how to resolve such big ass issues and can respond accordingly.

Quite literally the own ecosystem is trying to self correct itself, but in doing so, it had to cut its own true values in order to survive - at least in the moment.

There’s even a user willingly doing their part by helping reduce the risk factor for everyone by taking community advice.

Except, what happens when one economy (The Solana Network) is interconnected with other economies (Solend Lending, and tieing it to other stablecoins)?

Whatever principles you have, the other economies don’t share it, so you’re at their mercy as much as they are at yours. It seems like the more crypto projects connect with each other, and even bridge the gaps, the more they all share the same ocean tide.

Oh right takeaways:

If you know anyone study sociology, or studying econ, you tell them to get into crypto.

You tell them to do a case study on various crypto projects.

You tell them to watch one live and see when it implodes.

You tell them to tell the rest of us a story, and make it their PhD. :)

See you Friday.

The voting protocols (i.e. % of participants and time limits) is so far from a decentralized ideology. I can't wait to see it crash and burn!