In Web3, do you trust the protocol or the business? A Debrief on the Kraken v SEC announcement

Staking-as-a-Service is a sham; Staking by itself, not a sham. Somehow, the SEC figured that part out?

Hello Professionally Curious One!

Today we’re going to debrief the Kraken v SEC $30m settlement that was announced back on February 9, 2023.

Let’s chat, shall we?

Past Publications

Sections You Can Skim To

SEC Regulation, Kraken Crypto Exchange, and Knee-Jerk Reactions

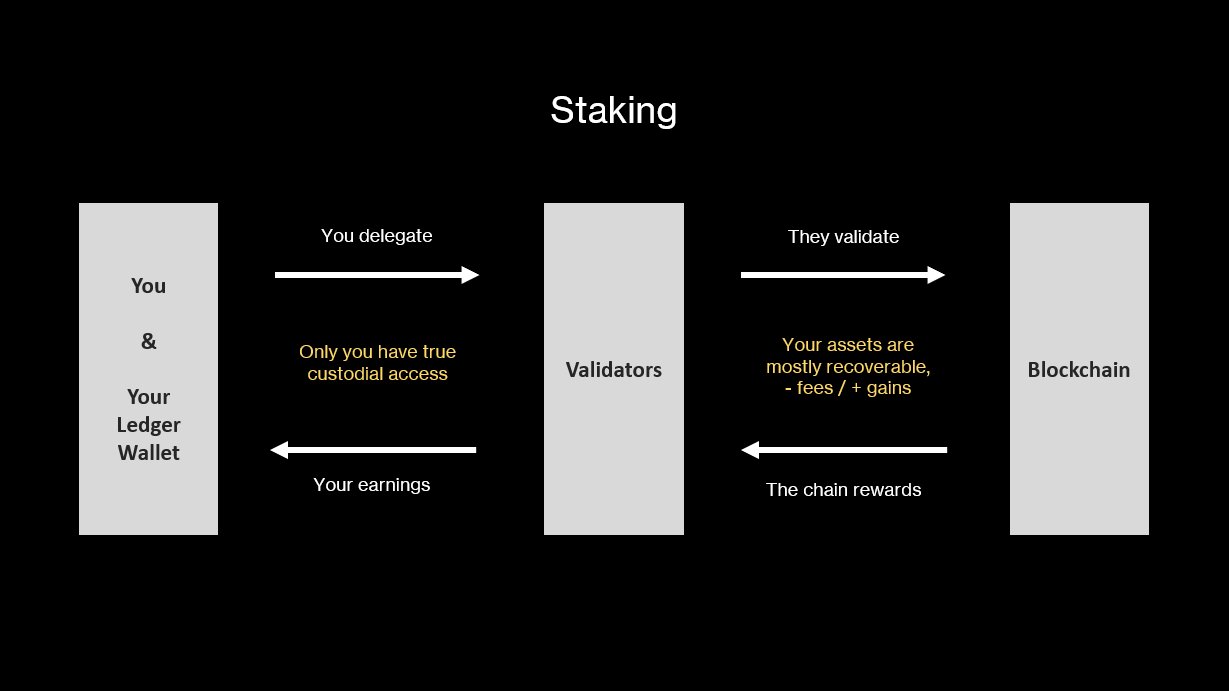

This is how direct Staking works.

This is how Staking-as-a-Service on a Custodial Entity works

Want to know who else was offering similar returns?

What are we trusting here?

SEC Regulation, Kraken Crypto Exchange, and Knee-Jerk Reactions

TL;DR: SEC orders Kraken to shutdown its staking-as-a-service program.

A few days ago, the SEC charged Kraken Exchange with “failing to register the offer and sale of their crypto asset staking-as-a-service program”. And then everyone had sensible, well articulated, and laid out thoughts I’m just kidding, everyone gets a knee-jerk reaction when the trifecta of “SEC, Regulation, and Web3” appears.

What has happened since is perhaps the most hilarious form of companies trying to be the robinhood hero of their fiefdom with the Coinbase CEO, and other CEOs, saying their product is different and they are protecting their own folks, and claiming the benefit for all.

Spurred about by Brian Armstrong, CEO of Coinbase, there was rhetoric around how the “SEC would like to get rid of crypto staking for U.S. Retail Customers”.

I want to point out:

Anyone remember the time when Brian was hated, and so was Coinbase? I think we’re still there. But more importantly…

Look at how this tweet is worded. It makes it sound like the SEC is here to crush you. It’s great tweet right? Makes Brian look like the Robinhood hero, the saving protoganist that will fight the government by shielding the people (his people).

This is all in context of the SEC decision to have Kraken cease their Staking-as-a-Service operations.

Today, you’re going to learn the difference between staking in the blockchain, and “Staking-as-a-Service”.

This is how Staking works.

TL;DR: It should be direct, secure, trustworthy, and 100% human-less.

In this above information technology flow,

You start from your own secure wallet that you only have access to “delegate” your crypto to a validator.

The act of delegation does not surrender ownership, or even give ownership, to a validator. It’s more of a technology driven consignment that when recalled, gives you immediate-ish access back to your assets. (note however there are smart contract scams disguised as staking protocols).

The validator takes the delegated crypto and is able to participate as a “node” in the blockchain (think of a “node” as a hardcore calculation pod that needs coins-token to be operated).

The blockchain provides the problems to be solved, and as validators solve them, those validators are rewarded by the blockchain itself - no human needed.

The validators act as a pass through entity where in those earnings go directly back to your position with the validator, without the input of the validator. In a way, one could say “it just happens” and “there were no humans to talk to about it.”

Important to Note:

You retained 100% ownership and access of your assets

Ideally no one else has access to it either since we’re doing this from your hardware wallet, or non-custodial wallet

Your risk of asset loss is constrained to “oh shit where is my wallet & what’s my password”. The value of the asset, however, is left to the Crypto Market Gods.

It’s not as easy to Stake securely as you might think

What’s ingenious about the blockchain is this concept of decentralization where everyone can just do things on their own, and if they can’t do it on their own, they’ll design systems that can do it on their own and everyone else can jump in.

Except now I have to figure out these different… dApps (Decentralized Apps), services, protocols, open a technical manual, shoot a telegram off, and ask Twitter on how to actually stake my assets safely. This was essentially what the market was experiencing for a long time.

Buying & selling bitcoin with fiat was hard before the simple UI experience + business services of Coinbase, Kraken, Binance - the things Centralized Exchanges grew on.

Right now, it’s still hard to stake safely. It’s the most weirdest “okay you have to do this, click that, go here, don’t do that, buy here, transfer there” conversation.

Not related - right now trying to figure out how to swap a crypto asset that isn’t very liquid, into another type of non-liquid assets, so that they can then stake it. This is not a finance problem, that’s just an Apple vs Windows 2006 problem.

This is how Staking-as-a-Service on a Custodial Entity works

TL;DR: Intermediary Middle Man companies are here to save you from the technical mess, but it’ll cost you your decentralization values.

Understanding the issues with adopting crypto, let alone staking it, centralized exchanges have moved in and created captivating experiences. They come with a caveat.

They tend to be custodial.

In exchange for either really easy user experiences, or enticing “Better than market” rewards, you surrender the direct ownership and privacy of your assets to Kraken.

In the above information technology flow, I have added “Kraken” and their “Staking-as-a-Service” program in to the staking mix.

Using your Kraken Exchange Custodial Wallet (it means they have access to take it), you deposit your crypto into a Kraken staking program.

Kraken then delegates your contributed token, with everyone elses’ pooled amount, to a validator (it could be their own node, but how is that verified?).

Regular blockchain validation operations commence, with Kraken interacting directly with the Blockchain and getting rewarded directly

Kraken then takes the received rewards and calculates your share of the rewards

You receive your earnings.

I’ve been in way too many SOC 1 TYPE 2 assessments and have had too many review notes on IPE/EAE to know that the following risks are present:

How do I know what I earn is complete & accurate?

What is “ownership” throughout this process, and what are my rights and obligations?

In the event of complete destruction, can Kraken shutoff withdrawals of my deposits?

What is my recourse?

Since this program that Kraken was offering is an unregistered security, yet they have full custodial access and promise of grand returns that are 2x or higher than market average, the answer is LOL I have no recourse.

My “investor” assets aren’t protected and guaranteed.

It’s like having a bank account, except it’s pre 1930, FDIC Insurance doesn’t exist, and all my cash can suddenly disappear.

Which is what happened to everyone that was a regular user at Celsius, BlockFi, Three Arrows Capital, and FTX. Anyone remember Anchor Protocol? They were a “Savings Protocol” that was yielding 20% APY on TerraUSD and contributed to the death of Luna, it’s 99.7% drop, and the wipe out of $60 billion in less than a week.

Want to know who else was offering similar returns?

TL;DR: Kraken was offering 20% APY, achieved through alternative investment strategies outside of direct staking.

Until the SEC announcement a few days ago, Kraken was rewarding users who were using their staking-as-a-service program with 21% APY. If you read into the briefing, you’d end up agreeing with the SEC on this in a similar energy as to you having guaranteed FDIC insurance on your bank account.

Here’s the excerpt from the SEC:

….since 2019, Kraken has offered and sold its crypto asset “staking services” to the general public, whereby Kraken pools certain crypto assets transferred by investors and stakes them on behalf of those investors.

….When investors provide tokens to staking-as-a-service providers, they lose control of those tokens and take on risks associated with those platforms, with very little protection.

The complaint alleges that Kraken touts that its staking investment program offers an easy-to-use platform and benefits that derive from Kraken’s efforts on behalf of investors, including Kraken’s strategies to obtain regular investment returns and payouts

In order to provide the yields that Kraken claimed, Kraken was doing investments outside of staking (which could be things similar to the whole FTX Real Estate thing) to supplement their promised returns.

Essentially this translates to “it’s not the protocol or blockchain providing the returns, its Kraken the Business figuring out how to be an Investment Company getting you returns.”

Who, or what are we trusting here?

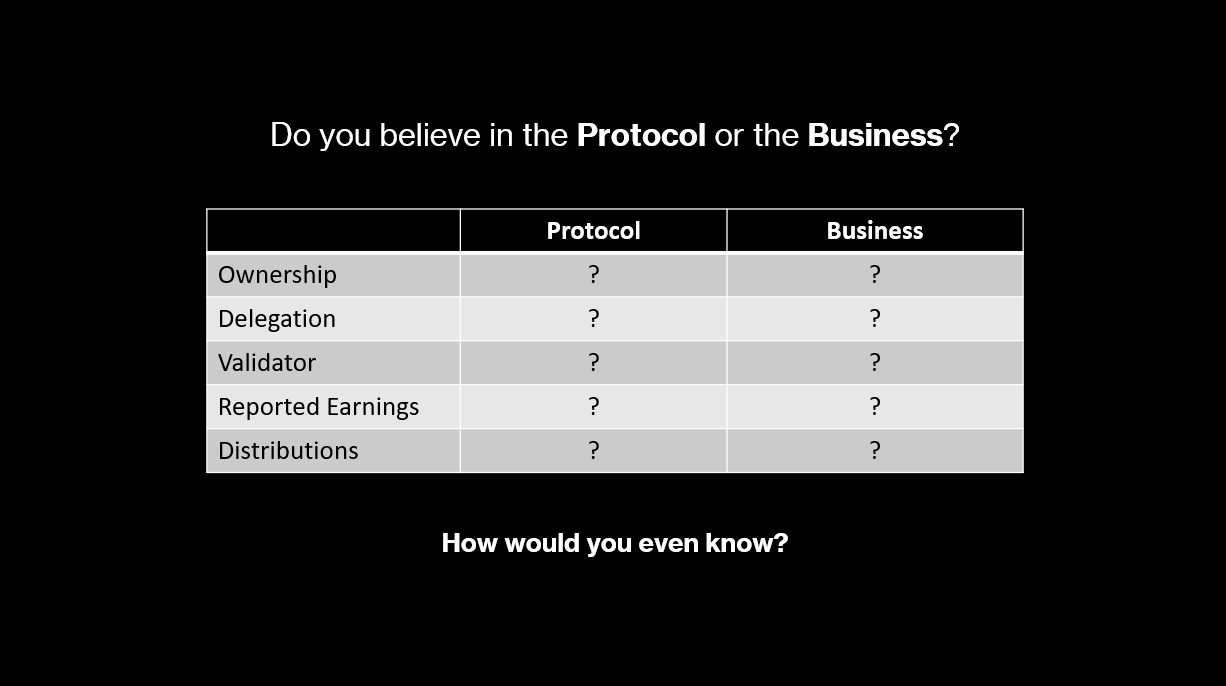

TL;DR: Do you believe that the protocol(s) are to be trusted, or the business? How would you know when one begins and the other ends?

I propose to thee a similar question:

Do you believe in the Protocol, or the Business?

How would you even know?

The SEC takes a position that the Staking-as-a-Service was more of a business, than it was a technology-only driven protocol. As such, that should be a registered security which offers protections for investors.

Here’s the comment:

“Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws,” said SEC Chair Gary Gensler. “Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

Please note that the above passage is focused uniquely on “Middleman Businesses like Kraken (see previous diagram)” and other “crypto intermediaries”. Its a comment at the businesses, not at the protocols/technology.

To understand the nuance of Protocols and Businesses/Apps, check out this read from a16zcrypto called “Regulate Web3 Apps, Not Protocols”.

As a finance professional that is so deep into crypto, you should know that every institutional company in Crypto has the best mobile app experiences and even desktop experiences (probably). They also have the most underdeveloped, overwhelmed, understaffed finance & accounting functions.

The professional word is “Not yet matured”.

And yet somehow Kraken held more than 5% of the total Staked ETH Market. If Kraken slip into “dire constraints” as an entity while holding on to your deposits, you lose. If Kraken gets eliminated, the rest of Crypto loses.

People will say it was the technology.

It was actually the business.

unchained is a good podcast with usually people who know what they're talking about. you would fit "right in"

Very comprehensive 😊 you should be on Laura’s podcast…