Payments and Middlemen - A shift from institutions to protocols

How Centralized Finance and Decentralized Finance are organized at a macro-level + new thoughts.

Hello Professionally Curious One!

BlockFi filed bankruptcy, and so begins another stream of “DeFi vs CeFi” banter. So I figure now is a good time to resurface my old thoughts around DeFi and CeFi at a macro level.

That’s right!

I am revisiting a previously published piece centered on “WTF is CeFi” and “WTF is DeFi”. It’s been some time, and I’ve had a wealth of experience to make me feel like an expert, so I figure updating the piece is appropriate.

In today’s piece you’ll explainers on how CeFi is organized at the big-picture level, how DeFi is organizing itself around technology, and my commentary on how it is all actually shaping out.

Enjoy.

Come back Friday for Spain pictures. ;)

In Case You Missed It

Sections You Can Skim To:

How are Centralized Financial Institutions organized? (CeFi approach)

How would Decentralized Finance be organized? (DeFi Approach)

How is it Actually Shaping? (The new part)

How are Centralized Financial Institutions organized?

TL;DR: CeFi or Centralized Finance/Traditional Finance is people trusting the business and its humans to execute specific operations as expected

Middleman Institutions in All Transactions

Centralized Finance, Traditional Finance, ala Central Authority, is a model that describes traditional financial middleman institutions such as banks, credit unions, brokerage firms, and so forth.

A CeFi Model entails people needing to trust a business (or a collection of businesses) and it’s human operators and human-based systems to perform the business services.

Such services usually include:

Transactional Processing Services (Doing the number crunching & transfers)

Treasury Services (Holding my money)

Reporting (Telling me how much I earned / loss)

Example of a Transaction before considering Credit Card Companies, Payment Processors, and Remittance-Type Companies:

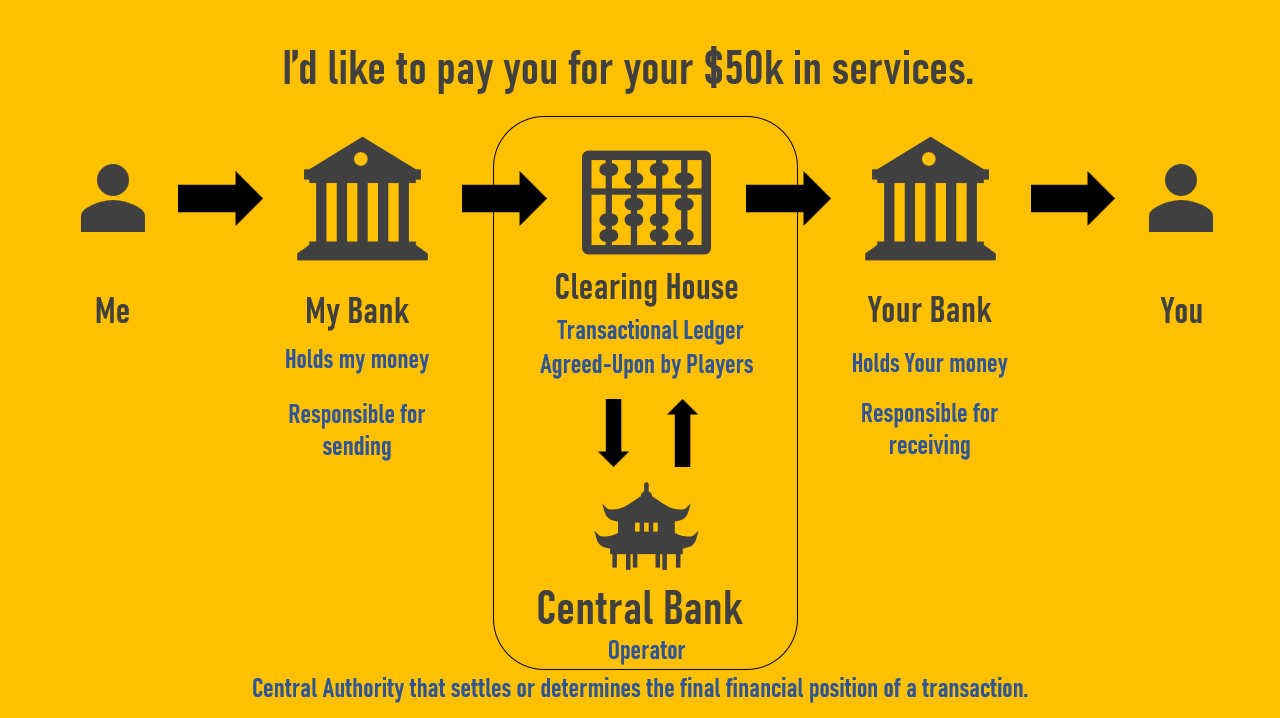

If you look at the above model, which is both a generalized conceptual model of a CeFi system, you’ll notice that at any given transaction there are at-least 5 different parties.

The sequence is this:

Payor

Payor’s Bank

Automated Clearing House ← Underpinned by the Clearing House Operator, or Central Authority

Payee’s Bank

Payee

There are around 100 Automated Clearing House systems globally, and you guessed it, its underpinned by a country’s central bank. Under this model, you are trusting the following parties to perform the following:

Payor’s Bank

To transmit my funds:

In the pre-digital age, quite literally sending money to someone was a pain in the ass since there used to be an element of physicallity to it, and thus, physical risk to your money can sometimes literally apply.To clerically maintain my account balances

Ensure completeness and accuracy of the data, and reporting of it in the form of bank statements

Central Authority

To settle, or dictate, the final account balances between banks

For 1 on 1 one-off transactions, you don’t need this level of rigor. However, the U.S. Automated Clearing House between the banks processed 29.1 Billion Transactions, or $72.6 Trilions of Dollars in 2021.

Payee’s Bank

To receive your funds:

To clerically maintain your account balances

Types of CeFi

While crypto, Coinbase is a CeFi. So is BlockFi. And FTX.

Chase and Wells Fargo are CeFi. But not crypto.

How would Decentralized Finance be organized?

TL;DR: Human-less financial processing - Decentralized Finance is people needing to trust the technology protocols to execute specific operations as expected

Replace the Middleman with Technology

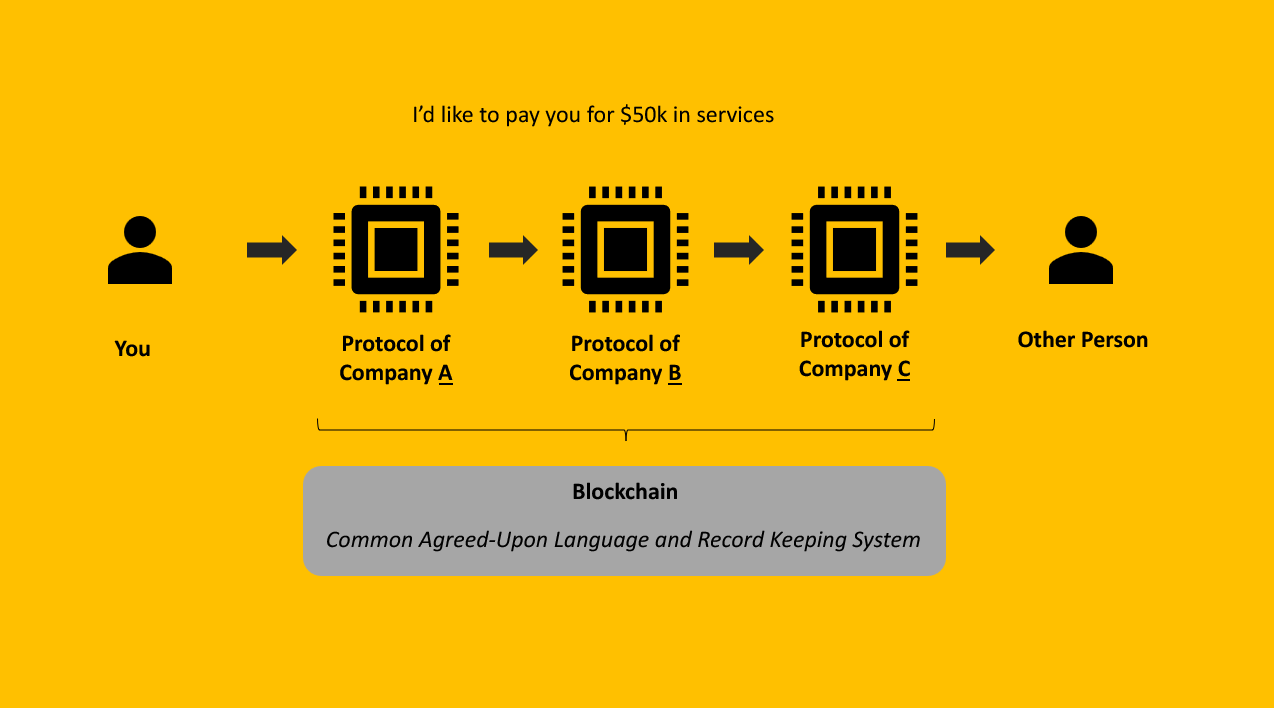

A DeFi model describes the absence of human-based businesses executing specific services, and instead has shifted the trust and reliance of execution to technology protocols.

Essentially, replace every human-driven business with automated technology scripts and protocols.

I know right? I didn’t say that was a good thing, I’m merely stating the thing.

Crude DeFi Representation

The above graphic represents a very simplistic explanation of the ethos of decentralized finance in that there is an absence of middle-man humans and businesses between transactions. However, I do not find this representation because describing Technology as a Monolithic Answer is too crude of a representation.

Expanded DeFi Representation

Using this graphic, I can better explain to you what’s going on.

I make a payment to you using the blockchain.

The payment is processed by the blockchain network.

The record of the transaction is stored publically for me, or really anyone, to see provided that they have the context for it. Not to say it’s publically broadcasted, no, it’s more that it’s publically available to be accessed.

You receive the funds.

Expanding on step #2 - the blockchain network-

No Humans: The entire transaction happens in the absence of a human operator pressing and deciding on the purpose and business value of a transaction.

Crowdsourced Computer Processing: The transaction is validated repeatedly across the network by other users computers. The users are many, where as in a CeFi the users are few. The record is held publically across all network users.

Public Ledger - Quite literally everyone can see how the transaction moved and got settled.

But is this it?

No.

How is it Actually Shaping?

TL;DR: Replace business with the technology systems…created by businesses.

The Technologies Are The Middleman

The best way I have come to understand and appreciate any blockchain is that it is at its core a set of roads that enable payments. They are the common roads to the city, the things you don’t really think about.

Another way to look at blockchain, from a business perspective, is that a blockchain is a Common Agreed-Upon Language and Record Keeping System (aka The Common Language) for computer systems, and subsequently, technology systems.

For those of you who are financial professionals, we have the luxury of common financial languages such as U.S. GAAP.

In the software engineering world, they have no such standard. Every company builds its own financial systems and technology to accept payments to wherever they can and want to do business in.

If we think of a blockchain as a common language for technology development of financial roads, you can appreciate the technology as I do: A giant delivery system using roads. Though instead of having people, we have technology systems as the intermediary.

I can see a day where Tech A, talks to B, which speaks to C, and goes down an exhausting alphabet of systems - but will you be aware that this happening? Probably not.

Do you know how many companies and how many steps are involved in shipping goods from one country to another, let alone one home to another home? There are so many middleman companies that are there to solve specific issues.

As someone who works in the financial side of blockchain, I can tell you that it’s still a pain in the ass to pay people in crypto - it’s just that my tools are different and the payment processing fee manifests differently. I mean, here look what I deal with:

Request Finance allows you to bill and collect using only crypto, and they take a %, and this is separate from the gas paid.

DeFi Protocols typically take a % commission, and this is separate from the gas paid.

Cryptomining software takes 1% of what you mine if you use their mining tool.

When I swap my crypto assets, I will incur a slippage (a translation loss due to inefficiency) that benefits the person I am trading with (even if they don’t know it) but not me, and then pay the swapping fee / trading fee on top of the gas.

This does not even address the wallets I have to connect and bridge, sometimes.

I suppose, instead of me groaning about Visa or Chase, I groan at all the service fees I’m getting charged by these intermediary protocol companies. It’s basically feels like getting a restaurant bill and then getting charged for tip, employee healthcare, convenience fee, credit card processing fee, and existence fee. There comes a point where I don’t actually need to know all these fees, just bake it in to the cost.

… this is a rant for later.

Anyhow, hope you enjoyed this. I have a lot of unfinished thoughts around Payment Processors and Payment Technologies and the absurd difficulty of them. I also have some unfinished thoughts on how the blockchain is basically parcel shipping (FEDEX, DHL, and UPS) in technology form. More on that another time, I suppose.