What Happens When You Double Your Income

Does doubling your income mean I can pay my debts 2x faster?

Welcome to the Friday Flight!

Just a nice collection of non crypto things.

I’m now a travel newsletter for the day. Just kidding. I’m worst. Financial musings newsletter.

Hasta la próxima semana!

Past Friday Flights

10/21: 1 Year After My EY-Exit

10/14: Thoughts on Work Travel

What I’m Up To

TL;DR: Went to Porto, Lisbon, and Seville. Currently on the way to Granada!

The Things

I tricked a lot of people in thinking I was in San Francisco.

Porto is my kind of city.

Lisbon is the best place to go to hang out with people.

Seville is the city that laughs at morning owls, and thrives into the night.

AMEX Travel Insurance is GOAT

I now have capacity to do more consulting work for any Blockchain-focused projects.

What I Reflected On

TL;DR: Does doubling your income mean I can pay my debts 2x faster?

No. A lot Faster.

Doubling Your Income, Doubling Your Payments

This is not financial advice. This is more of a financial musing.

Preface: This started off in a reddit thread where I read that doubling your income, and consequently, doubling your payment on debt, led to not a 2x impact, but a 3x impact. So here’s me mathematically proving that out. There are links to the excel doc for your musing.

Musing: Does doubling your income, and consequently, doubling your loan payments, mean you’ll get rid of the debt 2x faster?

Is it a linear gain?

Does a 30 year loan become 15 years when you double?

Finding: You will go even faster than 2x.

A 30 Year Loan paid at 2x minimum rate becomes a 10 year and 10 month loan

A 3x Factor (actual 2.79x)

A 10 Year Loan paid at 3x minimum rate becomes a 6 year and 8 month loan

A 5x factor (actual 4.55x)

Conclusion: Doubling minimum payment leads to non-linear benefits.

The Calculations

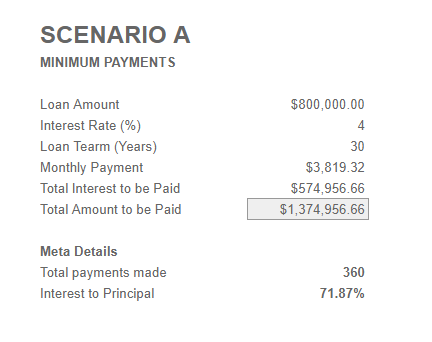

Scenario A - Minimum Payment

TL;DR: Interest alone will be over 70% your cost.

Let’s say you want to buy a $1,000,000 home with a 20% down payment. (suspend your disbelief, I believe you’ll get that $1m home, if not more!). Ignoring everything else besides an expected mortgage average interest rate of 4%, here’s what you need to know:

Your Mortgage Loan will be for: $800,000

This comes from the value of the home $1,000,000

less the down payment of $200,000

Your Minimum Monthly Payment: $3,819.32.

Number of Payments Needed:

30 Years x 12 Months

= 360 Payments

Total Amount Paid:

$1,374,955.20

How much you will pay over the duration of the loan

Summary

Your loan of $800,000 will cost a total of$1,374,955.20 -

but will cost you an interest of $574,955.20.

At 4% loan interest for 30 years,

interest will amount to 71.87% of your original loan.

Link to Google Sheets Workbook - See Scenario A

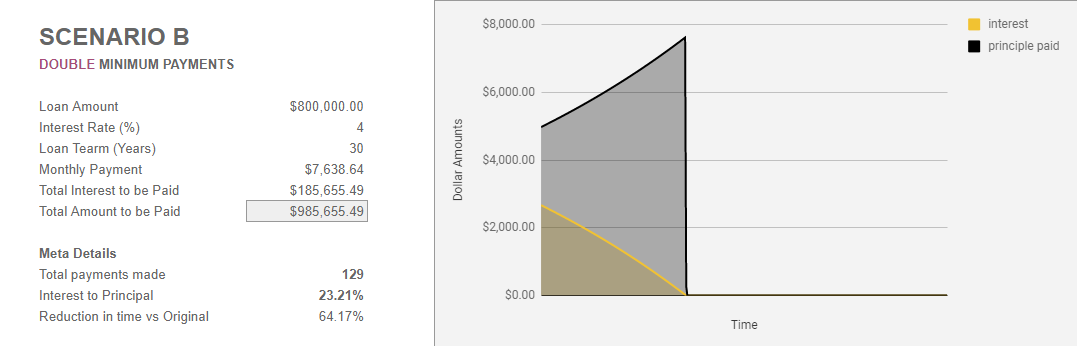

Scenario B - Double Minimum Payment

TL;DR: Pay that 30 year in 10 years.

Assuming the same circumstance and conditions, with only 1 change to the monthly payment (we’re doubling it!):

Your Mortgage Loan will be for:

$800,000

This comes from the value of the home $1,000,000

less the down payment of $200,000

Your Doubled Monthly Minimum Payment: $7,638.24.

Number of Payments Needed:

10 Years x 10 Months

= 129 Payments

Total Amount Paid:

$985,668.52

How much you will pay over the duration of the loan

Summary

Your loan of $800,000 will cost a total of $985,668.52

and will cost you an interest of $185,655.49

At 4% loan interest for 30 years,

interest will amount to 23.21% of your original loan.Doubling Minimum Payments gives you a 3x return (2.79x) based on time saved & a savings of $389k.

Link to Google Sheets Workbook - See Scenario B

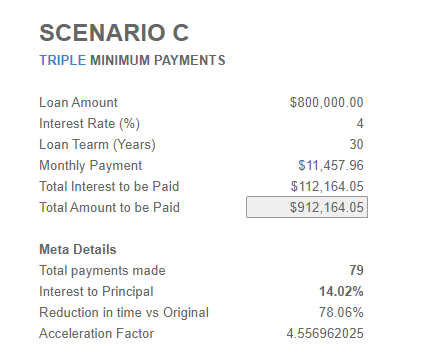

Scenario C - Triple Minimum Payment

TL;DR: Pay that 30 year in less than 6.5 years

This is actually what you will most likely do as doubling your income is in itself not a 2x impact to all parts of your life. More on that much later.

Assuming the same circumstance and conditions, with only 1 change to the monthly payment (we’re tripling it!):

Your Mortgage Loan will be for:

$800,000

This comes from the value of the home $1,000,000

less the down payment of $200,000

Your Doubled Monthly Minimum Payment: $11,457.36 (3 x $3,819.32)

Number of Payments Needed:

6 Years x 8 Months

= 79 Payments

Total Amount Paid:

$912,164.05

How much you will pay over the duration of the loan

Summary

Your loan of $800,000 will cost a total of $912,164.05

and will cost you an interest of $112,164.05

At 4% loan interest for 30 years, interest will amount to 14.02% of your original loan.

Tripling Minimum Payments gives you a 5x return (4.6x) based on time saved, and a savings of $462k.

Link to Google Sheets Workbook - See Scenario C

Comparing the Timelines

TL;DR: Acceleration of 3x or 5x.

Holding all things true in each scenario besides changing your minimum monthly payment, you can see how the expected time to pay off the loan drastically reduces when you double or triple your minimum payments.

When Doubling Minimum Payments: 3x acceleration

When Tripling Minimum Payments: 5x acceleration

Link to Google Sheets Workbook - See Summary

Do I double my minimum payments?

I’m not here to answer whether you should be paying off your debt at 2x. Holding debt can be beneficial, and a big driver to that lies in cashflow (actual dollars coming in, and actual dollars going out).

Do I need to reduce cash going out because I can use the cash elsewhere, and get better returns?

In a period of diminishing income, reducing cash flow out is great and can help relieve anxiety.

In a period of high-growth, you’d reverse the above decision and extinguish debt, and/or buy more things that appreciate in value better.

When answering the above question, you are most likely thinking of cost cutting measures. When it comes to individual finance, that tends to be the case.

Even the models I presented above focused purely on debt repayments point of view.

What we need to do together is actually start thinking of ways to increase income, and holding costs to be consistent.

The Impact of Doubling Income

When you double your income today, your current costs is expected to be the same + 10%. I made that % up.

If your income grew 100%, this means means you’ll have a sitting excess of it available to not just do double minimum debt payments, but triple, or quadruple.

Example: (Precision of # not important for this example.)

Assuming US - California:

In a year

You earn $120,000.

31% effective tax rate

That’s $83k take home.

After all costs and rent, but before long-term debt, you’d probably have $10-$20k.

When you double:

Assuming US - California:

You earn $240,000

36% effective tax rate

that’s $154k take home.

After all costs and rent, but before long-term debt, you will have $74k available

Which is essentially you have $50-60k more than previous.

Your excess cash amount after all costs, rent, but before long-term debt, increased around 5x when you doubled your income. Consequently, you would most likely accelerate debt payments across all long-term loans beyond doubling the minimum payment. ;)

I’m the kind of person that doesn’t find ways to reduce existing costs, but I find ways to increase income and revenue. I instead look for ways to reduce existing energy expenditures.

Enjoy these thoughts. Peace out.